08.08.2024

Over the past three years, Ukraine has gained a new transparent market worth UAH 829 billion. How did this become possible?

Three years ago, the organized commodity market gained new opportunities for legal and transparent trade, and Ukraine gained a new regulated segment.

This process was launched by the Law No. 738-IX on Amendments to Certain Legislative Acts of Ukraine on Simplifying Investment Attraction and Introducing New Financial Instruments, which amended a number of laws.

What are the results of the reform and the three-year operation of licensed commodity exchanges?

Creating an effective foundation

The reform has laid down a pro-European course for a unified approach to state regulation and organization of commodity trade, as Law No. 738-IX was developed to fulfill the obligations under the Association Agreement between Ukraine and the European Union.

Starting from July 2021, the legislation stipulates that all trade in standardized commodities (grain, wood, fuel) has been transferred to licensed exchange platforms. This means that standardized commodities can only be traded on licensed exchanges.

National Securities and Stock Market Commission (NSSMC), the regulator, is responsible for licensing exchanges, and exchanges monitor trading to prevent manipulation and insider trading.

To make Law 738-IX fully operational, the regulator has developed and brought 75 regulations in line with the law. These include new regulations for commodity platforms:

– the procedure for issuing, suspending and revoking a license to conduct professional activities on organized commodity markets (Resolution No. 275 dated 13.05.2021)

– licensing conditions for conducting professional activities in organized commodity markets – activities for organizing trade in products on commodity exchanges (Resolution No. 276 dated 13.05.2021);

– Regulation on the conduct of activities for the organization of trade in products on commodity exchanges (Resolution No. 380 dated 10.06.2021);

– Regulation on the procedure for compiling, submitting and publishing reporting data by commodity exchanges (Resolution No. 3 dated 13.01.2022).

NSSMC has also established cooperation with government agencies and international partners to ensure the effective implementation of the reform. In particular, the following agreements were signed

– an agreement on interaction and cooperation between the NEURC and NSSMC;

– Memorandum of Cooperation between the State Forestry Agency and NSSMC;

– a memorandum of understanding between the Government of Ukraine, the EBRD, the American Chamber of Commerce in Ukraine and the United States Agency for International Development on the establishment of a national mechanism for exchange trading in capital markets and organized commodity markets.

The state has created the appropriate legal and regulatory framework for the transparent functioning of the organized commodity market, but the market is shaped by the participants themselves, the supply and demand for certain goods.

What the numbers say

There are currently four licensed commodity exchanges operating in the commodity markets: Ukrainian Energy Exchange, Ukrainian Universal Exchange, Ukrainian Trading Platform, and Ukrainian Resource Exchange.

In the three years since the market was launched, commodity exchanges have seen transactions worth more than UAH 829 billion. These figures show not only the high volume of trading on the exchanges, but also indicate an increase in state budget revenues.

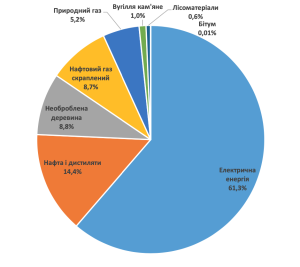

In recent years, the most traded commodities on exchanges have been electricity (61.3% of the total), oil and distillates (14.4%), and unprocessed wood (8.8%).

Breakdown of trading volume on commodity exchanges by type of commodity, 2023-2024

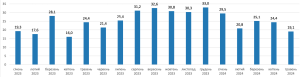

Total trading volume on commodity exchanges, 2023-2024, UAH billion

Traditionally, electricity holds the largest share of exchange trading. The market is actively developing despite the challenges of the war, and Ukraine is confidently moving towards the implementation of the best European practices in this area.

In the summer of 2023, Ukraine adopted the REMIT law, which is the basis for increasing transparency and healthy competition in energy markets and preventing abuse. The National Energy and Utilities Regulatory Commission, NSSMC, and the Antimonopoly Committee have pooled their efforts and expertise around the REMIT law, working to ensure an effective outcome and successful implementation of the law.

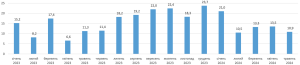

Total volume of electricity traded on commodity exchanges, 2023-2024, UAH billion

The timber market has come out of the shadows

The law has made it possible to put the timber market on a transparent and competitive track. Equal access for participants, competition between buyers, confidentiality, non-discrimination, and prevention of abuse reduce the size of the shadow market and create conditions for additional revenues to the state budget.

Market participants positively assess the results of timber exchange trading over the past three years and note the high level of performance of licensed commodity exchanges.

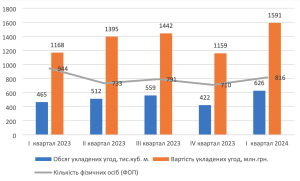

Over the past three years, the exchanges have concluded transactions for more than 24 million cubic meters of unprocessed wood and timber worth more than UAH 63 billion. In 2023 alone, this figure amounted to UAH 28.8 billion. In the first quarter of 2024, the volume of transactions increased by 122% compared to the third quarter of 2021, and the value of transactions increased by 86%.

Over the past five quarters, the volume (35%) and value (36%) of timber and timber products transactions by individuals have increased. This demonstrates transparency, accessibility, and non-discrimination in timber procurement.

The military aggression and the imposition of martial law have affected the woodworking industry, logistics services, and energy supply. Even in such circumstances, regular auctions help to support the economy, as many companies keep their jobs and can pay salaries and taxes on time.

There is a tendency to increase the volume and value of timber transactions. This suggests that the current approach of selling timber exclusively on the organized commodity market, operated by commodity exchanges licensed by NSSMC, has proven to be effective.

Near-term prospects

Ukraine is confidently pursuing a European course, so more and more European mechanisms and practices will appear on organized commodity markets.

The regulator’s immediate plans include the implementation of new financial instruments, building close cooperation with all partners, and creating favorable conditions for businesses to expand the range of goods. Transparent pricing and legal trade create a competitive and investment-attractive market.

Source: EPravda

Зв'язатися з нами