25.09.2023

What you need to know about derivative contracts and derivative securities

The National Securities and Stock Market Commission (NSSMC), together with LIGA.net, has prepared a series of publications to explain the essence and specifics of financial instruments and mechanisms of their use in a simple and accessible manner.

A developed stock market in Ukraine is an ambitious goal. To achieve it, it is not enough to have a variety of financial instruments. We need participants – individuals and companies – who will use these instruments. And to use them, you need to understand them.

In the first publication, we will analyze what derivative instruments are, their groups, their functions, the life cycle of derivative instruments, and the possibilities of their use in Ukraine and globally.

Prerequisites for the emergence of derivative contracts and derivative securities

Conventional financial instruments (such as stocks, bonds, promissory notes, deposits and loans) and commodities are an integral part of modern life.

However, the acquisition, holding and sale of such assets always involve certain risks. These risks may arise from the economic situation (price fluctuations), political situation, exchange rates and other factors. When a potential party to such a relationship recognizes the existence of risks, it begins to look for mechanisms to minimize the risks on its own or to transfer them to another party.

To minimize these risks, parties to transactions use various mechanisms. One of these mechanisms is hedging. Hedging is a transaction that allows a party to a transaction to protect itself from the risks of changes in the price of an asset.

The development and inter-integration of markets (stock and commodity) require the creation of new financial instruments and hedging mechanisms to help transaction participants protect themselves from risks.

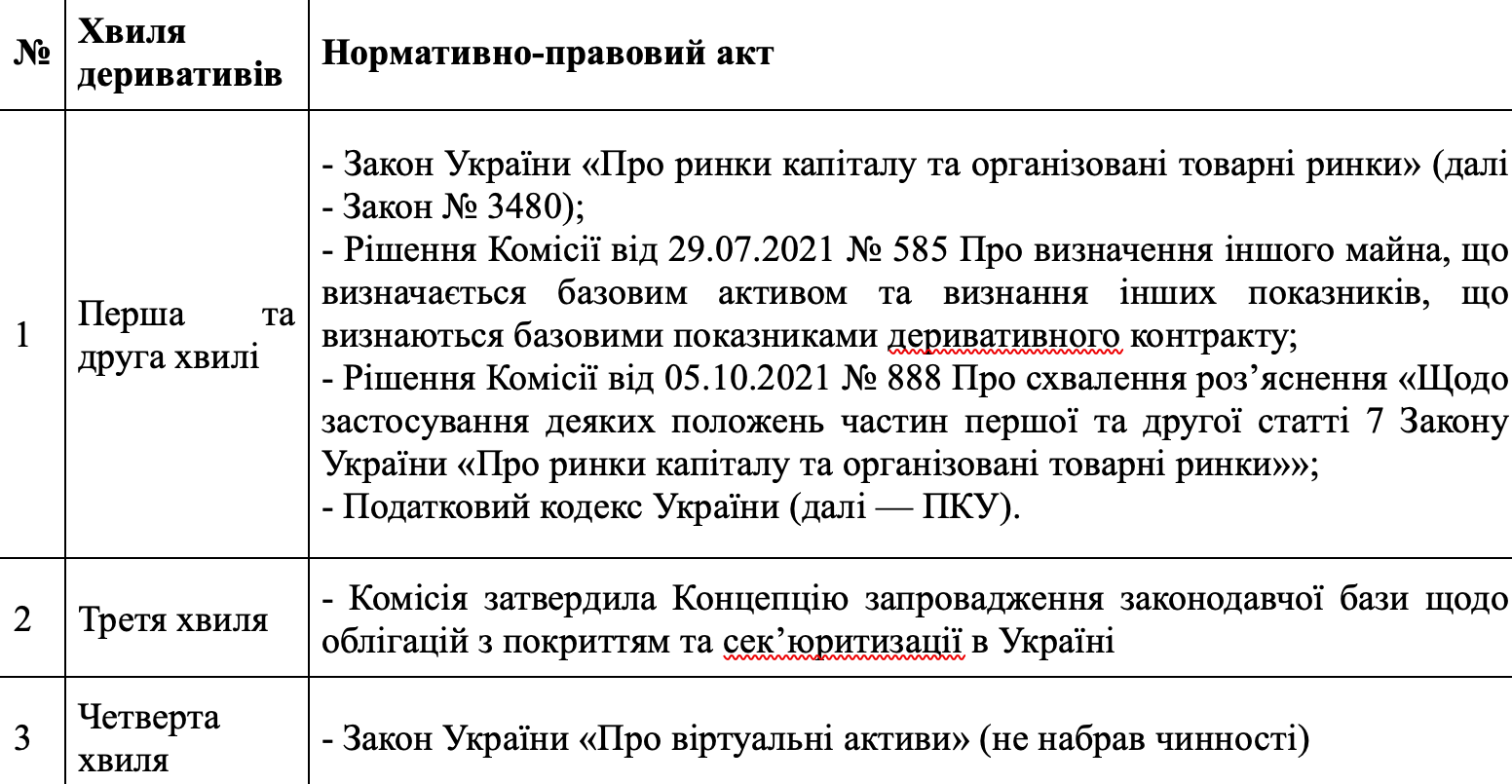

It is this demand that gives rise to new mechanisms and structuring of transactions. This process has a wave-like character, usually distinguished by several groups (waves):

1. The first and simplest derivative instruments (forwards, futures, swaps, options, and warrants).

2. Credit derivatives (credit default swap, credit notes).

3. Securitization (this mechanism will be discussed in the following publications).

4. Virtual assets, i.e. the transition to «digital» (these instruments will be discussed in the following publications).

A characteristic feature of these instruments/mechanisms is that they are derivative, i.e. derived from other assets or indicators.

This means that there are primary instruments/assets (stocks, bonds, loans, deposits, goods, services, indicators, etc.), also called the underlying asset or underlying indicator, and derivatives (derivative instruments) from them.

In simple terms, a derivative is an agreement under which the parties are obliged or entitled to receive/transfer the underlying asset in respect of which it is concluded on certain conditions.

What are the functions of derivatives?

Derivatives have several functions:

- – Risk hedging – transfer of risk from persons who are not adapted to risk taking and do not want to take it to persons who have an excessive risk taking capacity. While for the first derivative instruments the main risk to be hedged was the risk of changes in commodity prices, for the next «waves» of derivatives the emphasis began to shift to credit and liquidity risks.

- – Price forecast. Derivatives follow the spot market (where assets are traded instantly) and reflect market participants’ expectations for the future.

- – Gaining speculative benefits.

What are the main features of derivative instruments?

Derivative instruments have the following features:

- 1. A link to an underlying asset or indicator. If there is no asset, there can be no derivative instrument. That is why the instrument is called a derivative.

- 2. Time reference. The agreement must specify the term of its execution, otherwise the transaction loses its meaning. There are two models for determining the term: American (when a period is specified) and European (when a certain moment is specified).

- 3. Fixed price. Despite the fact that the transaction with the underlying asset will take place only later, the price is set by the parties in advance.

What does the life cycle of derivatives look like?

It all starts with the conclusion of a transaction (it can be concluded on an organized market or outside it).

The next stage is the circulation of derivatives. The format of the transaction depends on the form of the derivative: if it exists in the form of a security, purchase and sale agreements are used; if it exists in the form of a derivative contract, then agreements on the replacement of a party to the derivative contract are used.

The final stage of a derivative’s existence is its expiration (from the Latin exspiratio – expiration of the term) – the fulfillment by the parties of their obligations under the derivative instrument in respect of the underlying asset.

It is important to note that derivative instruments are not transactions identical to contracts for the sale and purchase of the underlying asset in the future, and the expiration date is the day on which the same deferred transaction with the underlying asset is concluded and the relevant settlements are made.

Thus, a derivative (as a hedging instrument) expires when the parties have moved to its execution. In other words, if the parties have entered into a transaction (payment/delivery) with respect to the underlying (original) asset, the derivative wrapper has been unwrapped and the hedge is over.

What do we have today?

Ukraine is constantly working to create and improve the legal framework for the functioning of derivatives:

Another document worth mentioning is the Resolution of the Cabinet of Ministers of Ukraine No. 632 dated 19.04.1999 on the approval of the Regulation on Requirements for Standard (Model) Forms of Derivatives.

This document is outdated and was supposed to expire when the new version of the Law No. 3480 on Capital Markets and Organized Commodity Markets came into force on July 1, 2021. The norms contained in this CMU resolution are outdated and distorted by market participants.

In practice, only derivatives of the first two waves are effective. The main document regulating relations in this area is Law No. 3480, which divides derivative financial instruments into

- – Derivative contracts (forward, futures, swap, option, credit default swap, swap, swap futures, swap forwards, swap forwards, price difference contract, future interest rate contract and other transactions that meet the definition of Article 31 of this Law)

- – derivative securities (option certificates, stock warrants, loan notes, depositary receipts and government derivatives).

However, these derivative instruments are not used to their fullest extent, and this is due to two reasons.

First, not everyone understands the economic essence of certain instruments, and therefore cannot use them effectively.

Secondly, the provisions of the Tax Code of Ukraine (TCU) have not been brought into line with the provisions of Law No. 3480. It is understood that tax accounting is conducted in accordance with the requirements of the TCU. If the TCU contains certain terms, the taxpayer (for tax accounting purposes) should be guided by the terms specified in the TCU.

Thus, the discrepancy between the terms used in the TCU and the Law on Capital Markets and Organized Commodity Markets causes market participants to be reluctant to use such instruments.

Thus, the discrepancy between the terms used in the TCU and the Law on Capital Markets and Organized Commodity Markets makes market participants reluctant to use such instruments.

Who uses derivatives in the world and why?

Thousands of companies around the world use derivatives to reduce risks to their business and increase the confidence of their customers.

We are pleased to present a new animated video by the International Swaps and Derivatives Association (ISDA), which shows how derivatives are used by many types of companies around the world.

Mortgage operators, for example, use derivatives to offer homebuyers a choice of fixed or floating rate mortgages.

Banks also use derivatives to manage the risk of their loans, allowing them to lend more.

Pension funds and asset managers use derivatives to help optimize and protect the value of pension portions and investments, allowing people to plan for the future with greater certainty.

Commodity producers also use derivatives. When they want to raise money for new investments, they can use an interest rate swap to lock in financing costs, thereby reducing the impact of potential interest rate increases.

Food and beverage companies use derivatives to manage the risk of fluctuations in the price of their ingredients. This helps to ensure the stability of the supply and price of the customer’s favorite food.

The same goes for energy prices. Producers and suppliers use derivatives to help smooth out the regular ups and downs of gas, oil, and electricity prices, reducing volatility for consumers.

Similarly, airlines use derivatives to lock in fuel costs, which helps mitigate the indirect impact (the «domino effect») on ticket prices.

The ability to create confidence and stability is extremely valuable and vital to global economic growth.

In future publications, we plan to familiarize market participants with the current mechanisms for using derivatives and the potential of instruments (first and second waves) that have never been used before.

Source: LIGA.net

Зв'язатися з нами