14.11.2023

What you need to know about the types of securitization and the purpose of each of them

The National Securities and Stock Market Commission (NSSMC), together with LIGA.net, has prepared a series of publications to explain the essence and specifics of financial instruments and mechanisms of their use in a simple and accessible manner.

In the previous publication, we formulated a general concept of the securitization process: its essence, purpose and history.

As a reminder, securitization is a mechanism for refinancing assets through the issuance and placement of securities. At the same time, securitization is a very flexible, multifaceted mechanism that has a large number of configurations that are structured depending on the purpose and capabilities of its participants.

In this publication, we classify the main types of securitization, when they are used and for what purposes.

Types of securitization

The main criterion used to classify securitization is the method of risk transfer, according to which securitization is divided into classical, synthetic and corporate securitizations.

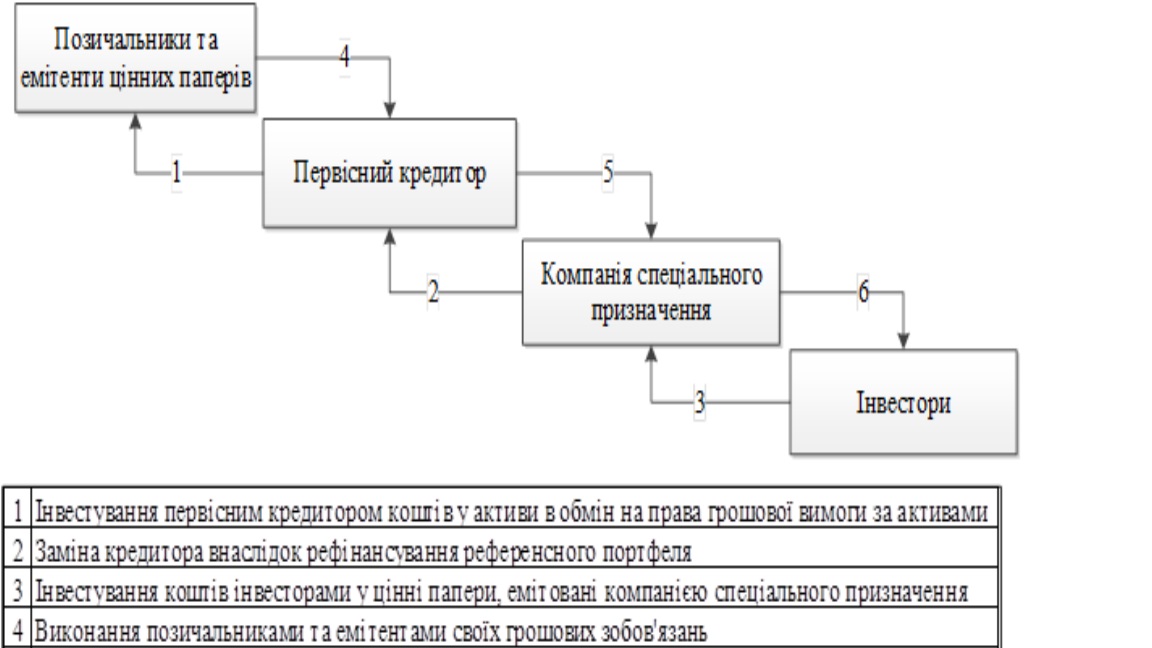

Classical (traditional/vanilla) securitization, originally known as true sale securitization, is a simple and effective method of asset refinancing. In fact, the very name «true sale» reveals the main feature of this type of securitization – the alienation (transfer) of the asset pool from the original lender (originator) to a special purpose vehicle (SPV). This means that along with the transfer of control over the asset pool from the original lender, all risks in relation to such asset pool are transferred.

In turn, the SPV pays for the asset pool by placing at least two tranches (classes) of securities, the payments on which are secured by the proceeds of the asset pool.

Scheme 1: General scheme of securitization based on the principle of true sale

The main advantage of this type of securitization for investors (buyers of SPV securities) is protection against bankruptcy of the original lender (originator). In addition, since the asset pool is separated from the original lender, it is not subject to any restrictions or credit rating of the originator.

Classical securitization is an attractive refinancing mechanism for banks, as their activities are limited by established regulations. Thus, transferring assets and receiving refinancing allows banks to optimize the value of economic ratios and continue lending with the funds received from the SPV.

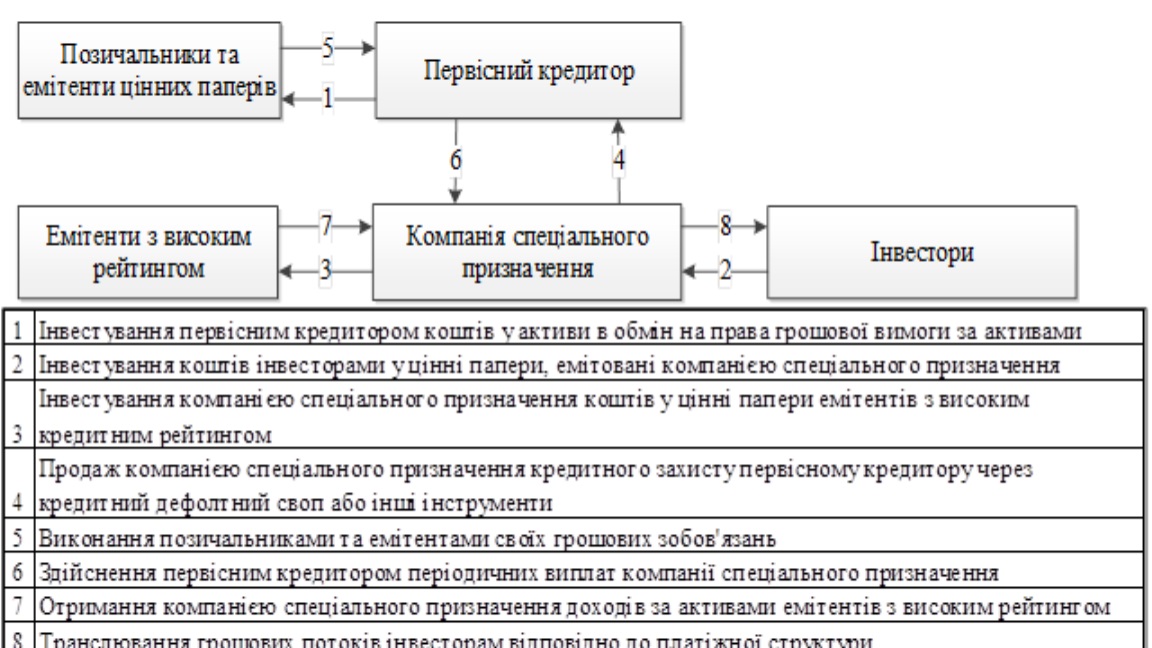

Synthetic securitization is a more complex and indirect method of risk transfer – the originator does not sell the assets and keep them on its balance sheet. Instead, it uses credit derivatives, usually credit default swaps (CDS). Credit derivative instruments specify the terms under which the buyer of the protection (originator) agrees to pay compensation to the seller of the protection (SPV) in the event of certain credit events, such as a borrower default, restructuring of liabilities or other credit event, or a downgrade of the credit rating of the underlying assets.

The main purpose of synthetic securitization is to transfer risks. It can be carried out both with and without the creation of an SPV.

In the first case, the credit risk is transferred to a special purpose vehicle, and the vehicle, in turn, issues at least two tranches (classes) of securities, the repayments of which are secured by proceeds from credit derivatives and investment in risk-free assets.

In the absence of an SPV, the originator transfers the credit risk directly to the market (investors).

Figure. 2. General scheme of unfunded synthetic securitization using SPVs

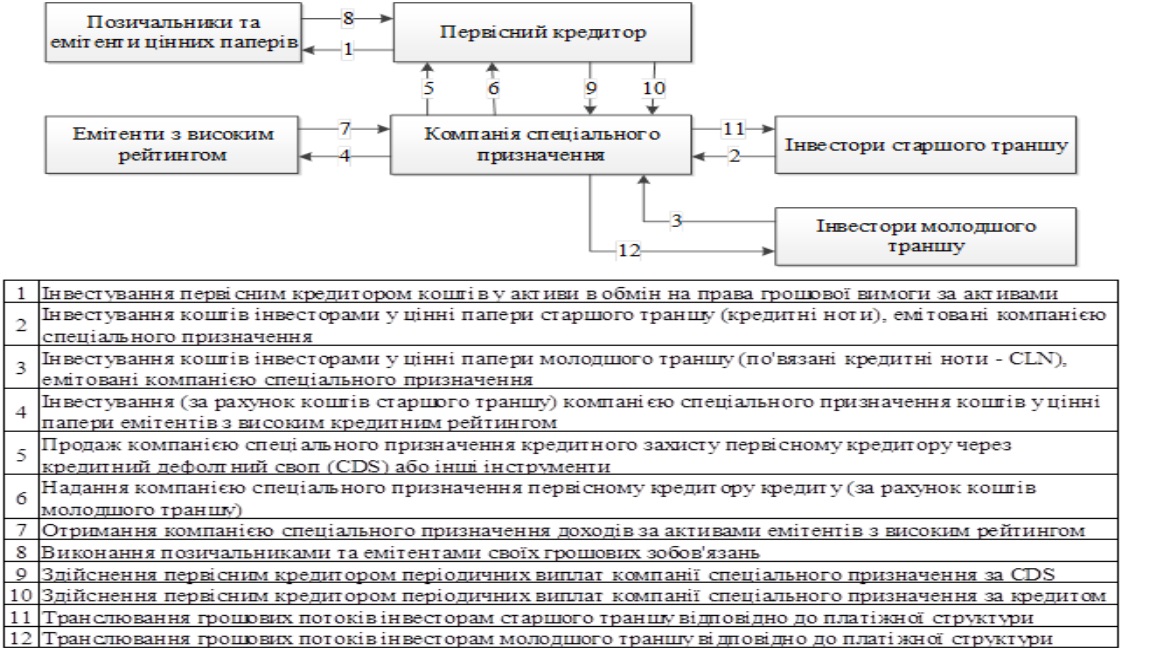

Partially funded synthetic securitization is also noteworthy and may be interesting for domestic originators. This type involves providing funding to the originator, but without transferring the reference portfolio to the SPV’s balance sheet; only the risks on such a portfolio are transferred.

As in the other examples, in the case of a partially funded synthetic securitization, the SPV raises funds by placing at least two tranches (classes) of securities.

Here it is appropriate to explain what tranches of securities we are referring to.

Thus, the financing to be raised in the securitization process is divided into several parts called tranches or classes of securities (this process of distribution is also called stratification). Each tranche is characterized by different levels of return and risk from the other tranches and is placed separately.

A typical securitization structure involves at least two tranches, a senior tranche and a junior tranche, with subordination between them, which means that investors in different tranches have a priority of claims.

For example, investors in the least risky senior tranche should be the first to receive income, while the claims of investors in the most risky junior tranche (sometimes called the first loss tranche) are satisfied last. It is quite obvious that the yield on junior tranche securities is set at a higher level than the yield on senior tranche securities.

Now let’s return to the partially funded synthetic securitization.

The peculiarity of a partially funded synthetic securitization is the use of credit-linked notes (CLNs), which provide for the issuer of the CLN to extend a loan to the originator using the funds received from the placement of the junior tranche.

At this time, the funds received from the placement of the senior tranche will be used to invest in risk-free assets that guarantee payments on the senior tranche securities.

As for the transfer of the reference portfolio risk, it is transferred by means of CDS, which provides additional income for payments on securities issued by the special purpose vehicle.

These credit derivative instruments (credit notes and credit default swap) were discussed in our previous publications (link here).

Scheme 3. General scheme of a partially funded synthetic securitization

To summarize, synthetic securitization is suitable for those originators who do not have difficulties with continuing to hold the reference portfolio on their own balance sheet.

At the same time, synthetic securitizations can be either unfunded or partially funded.

Classical and synthetic securitization are two effective approaches to risk management and asset refinancing. The choice between these methods depends on specific objectives, asset types, and regulatory constraints. The Concept for the Implementation of the Legislative Framework for Securitization approved by the Commission provides for the possibility of using both types of securitization.

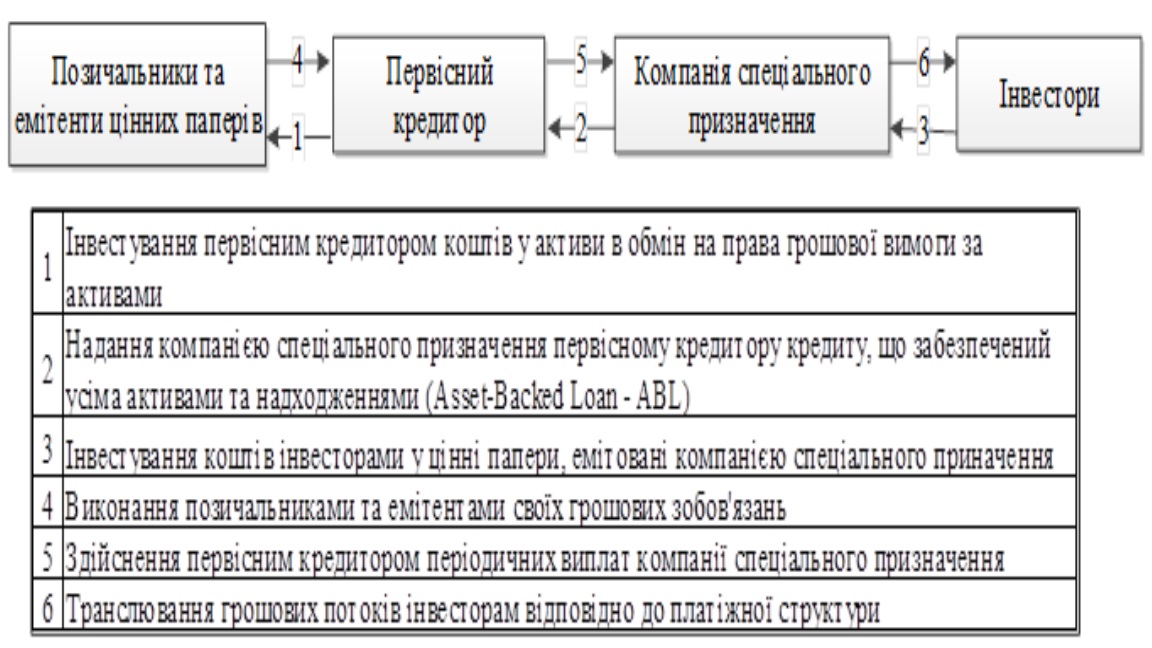

Corporate securitization (whole business securitization – WBS)

Over the past 10-15 years, experts in the UK and the US, realizing that the possibilities of the securitization mechanism are much wider than those used in the classic or synthetic version, have begun securitizing not just specific assets (classic securitization) or just risks (synthetic securitization), but the entire business.

Corporate securitization (WBS) or operating-asset securitization (OAS) is a financial mechanism used by companies to raise capital by transferring most or all of their operating assets and their cash flows.

WBS is a method of structured finance that allows a company to access capital by pledging its entire business, including tangible and intangible assets, as collateral. This type of securitization is typically used in industries such as restaurant, hospitality, and pharmaceuticals, where the company’s revenue streams are predictable and stable.

The cash flow from these assets is used to cover the debt and the basic level of operating expenses. A unique feature of the WBS is the ongoing involvement of the issuer (SPV) in the management of the business to generate the expected cash flow, maintain asset value and support the brand.

Scheme 4. General scheme of corporate securitization

However, corporate securitization can be implemented only in some countries that allow the use of irregular collateral (floating charge).

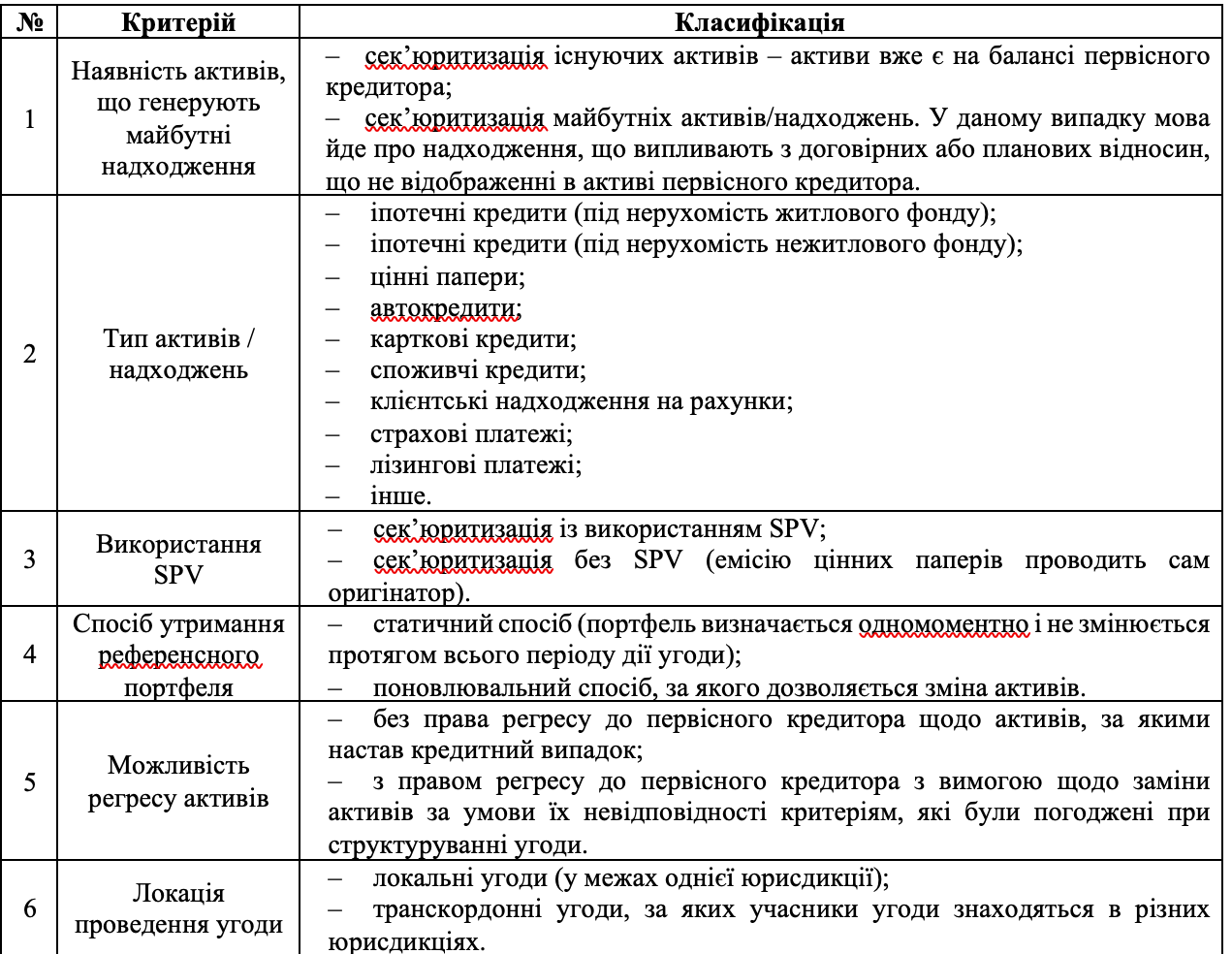

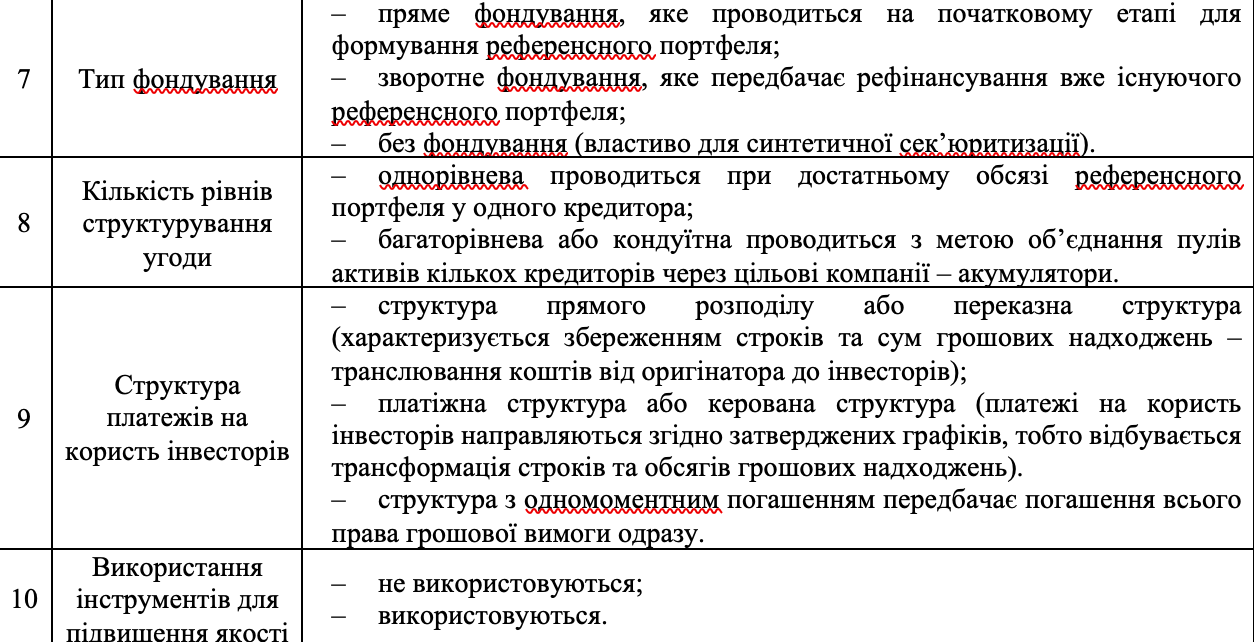

As we noted at the beginning of this publication, there are a large number of securitization configurations that can complicate or simplify the mechanism. Below is a classification of modifications to basic securitization schemes.

Table 1: Classification of modifications of basic types of securitization

Conclusions

Securitization is a flexible and efficient mechanism for (re-)financing assets and hedging risks that has long been successfully used by our international partners. The choice of specific model configurations is made during the structuring of each specific transaction and is based on the motives of all stakeholders (government, originators, borrowers, hedging providers and potential investors with certain investment expectations).

In the following publications, we will talk about mechanisms for improving the quality of structured securities, requirements for participants in the securitization process and examples of its implementation (both the most common and the most exotic).

Зв'язатися з нами